Comparing Two Big Moments in Domain Sales: Blockchain.ai vs the Recent Onchain domains

12 Oct, 2025

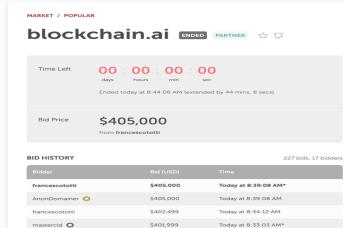

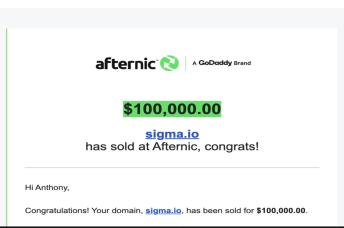

This week the domain market lit up with two related but very different stories: the headline-grabbing sale of Blockchain.ai for $405,000, and a cluster of strong—but smaller—sales for variations of Onchain: Onchain.cc ($39,999), Onchain.one ($25,000) and Onchain.fm ($5,000). All four sales are real and were reported across NameBio and domain industry outlets.

Below I break down what these results mean for domain investors and beginners, why Blockchain.ai looks like the marquee sale, and whether the Onchain family could still climb higher.

Quick factual snapshot (what happened)

Blockchain.ai — $405,000 (auction) — a high-profile expired-domain auction that finished at $405k. The sale has been widely reported and has even prompted follow-up legal/ownership discussions.

Onchain.cc — $39,999 (Efty / reported) — a six-figure-ish headline for the .cc sale that ranked among the top .cc results recently.

Onchain.one — $25,000 (Afternic / reported) — another strong sale, listed as one of the daily top sales on NameBio/Afternic listings.

Onchain.fm — $5,000 (reported) — a smaller but notable purchase reported alongside the other Onchain transactions.

Why blockchain.ai feels bigger — and why that feeling is backed by real factors

1. Single-keyword + top-level relevance

“Blockchain” is a single, category-defining keyword. When paired with .ai — today’s de facto extension for artificial intelligence businesses — the result is an immediate, global brand with exact-match clarity. That kind of naming power typically commands a premium.

2. .AI as a premium tech TLD

The .ai extension has become synonymous with cutting-edge AI startups and products. Buyers in that space often pay more for short, obvious, trust-building names on .ai than they will for similar names on less-recognized extensions. (Compare buyer psychology for .ai vs .cc / .one / .fm.)

3. Scarcity & perceived buyer use-case

A domain like Blockchain.ai can serve as the brand name for a multinational platform, venture fund, conference, or publisher targeting both blockchain and AI communities. That perceived utility increases its strategic value—much more so than niche or regional TLDs where buyer use-cases can be limited.

4. Auction dynamics and visibility

The blockchain.ai result came from a high-visibility auction and produced considerable industry buzz (and even legal follow-up), which amplifies perceived value and media impact. High-visibility auctions can create momentum and competitive bidding that push numbers higher.

Why the Onchain sales still matter (and why they’re impressive)

1. Volume & coordination

Three Onchain domains changed hands within a short window (cc, one, fm). That pattern—multiple similar keyword purchases—often points to either a strategic consolidation by one buyer or multiple buyers reinforcing a trend. Consolidation like this can be the first step toward building a branded portfolio or platform. Industry posts and reporting flagged the clustered nature of these deals.

2. .CC and .ONE can be brandable in the right context

While .cc and .one are not as “premium” as .com or .ai in general perception, they can work very well for specific audiences (blockchain projects, token platforms, one-click solutions, global products). A strong short keyword like Onchain paired with a memorable extension can attract strategic buyers who want a clear identity.

3. Market validation for the keyword itself

Three sales for “Onchain” variants show that the keyword has real demand. It signals buyer interest in the exact term and raises the floor price for future sales of similar names.

Side-by-side: why blockchain.ai outran Onchain. in price

Brand gravity: “Blockchain” + “.ai” targets two megatrends (blockchain + AI) in a single, instantly understandable package. That combination is rarer than the “Onchain” string across multiple extensions.

TLD prestige: .ai currently carries higher perceived value for tech startups than .cc / .one / .fm. Buyers often equate .ai with AI-tech credibility.

Buyer use-case size: The likely buyer pool for Blockchain.ai includes large companies, funds, or media brands prepared to spend mid-six-figures for an iconic name. The Onchain buyers are more likely strategic consolidators or niche projects with smaller budgets.

Could the Onchain domains climb to match Blockchain.ai later? Short answer: possible — but unlikely to reach the same level in the near term.

Here’s why—and what would need to happen if Onchain.* were to jump higher:

How it could happen:

A large well-funded buyer (big crypto exchange, major Web3 aggregator, NFT/onchain identity company) could decide to build a flagship brand around Onchain, pay a premium, and then either operate the business or flip the name later. Consolidated brand strategy across .cc, .one, .fm, and other extensions could create synergies that increase perceived value. Reports of coordinated acquisitions suggest this might be in play.

Barriers that make parity unlikely (short term):

TLD perception: .ai is currently more valuable for the specific AI/tech audience than .cc/.one/.fm.

Single-target vs. multi-TLD fragmentation: A single standout exact-match premium (Blockchain.ai) usually outvalues several related but differently suffixed domains unless those are aggregated under one cohesive brand or platform.

Market depth: There’s a limited pool of buyers willing to spend 6-figures for anything other than world-class, category-defining names (single-word .com or niche yet highly relevant TLDs like .ai).

Bottom line: the Onchain names could rise further—especially if a strategic buyer consolidates and builds around them—but reaching the same six-figure-plus level as Blockchain.ai would likely require a large organization to commit to that specific brand vision and pay a premium for it.

What domain investors (and beginners) should take away

1. Keyword quality matters more than extension—but extension matters too.

A powerful single word on a relevant premium TLD (e.g., Blockchain.ai) can beat multiple good names on weaker TLDs. Always weigh both components.

2. Watch buyer intent, not just the sale price.

A name that can be used by a global business or platform has more exit options. Ask: who would pay X dollars, and why would they use it?

3. Clusters of purchases can be a signal.

Multiple sales around the same keyword (the Onchain cluster) often mean a buyer is forming a strategy. That can be a chance for flip opportunities, or to learn which keywords are heating up.

4. Auctions and publicity increase price—but also bring scrutiny.

High-profile auctions attract attention (and sometimes disputes). They’re great for headline prices, but legal issues or ownership claims can slow transfers and complicate deals. The blockchain.ai result was widely covered and is already noted in follow-ups.

5. Diversify your portfolio strategy.

Don’t chase only viral auction prices. Mix: a few high-quality, long-term holds; some mid-tier speculative plays; and smaller, fast-turn names for cash flow.

Practical steps for beginners who want to learn from these sales

Track marketplaces & NameBio daily. Seeing what actually sells (vs. listed) trains your market sense. NameBio and industry roundups flagged these recent sales.

Build a buyer list: For each premium name you own, list the 5–10 potential acquirers and why they’d buy.

Study auction history & comparable sales: Compare similar keywords, TLDs, and sale venues.

Network in domain forums: NamePros, domain Twitter/X posts, and industry newsletters often reveal early signals and private deals.

Motivational notes & quotes for domainers

> “Buy the name that solves a problem before the company knows it has that problem.” — Adapted for domainers

> “In domain investing, patience compounds value. A single perfect name can fund your next ten purchases.” — BlissDomain.com

> “Watch trends, but invest in words. People remember words long after the trend fades.” — Emmiey Bliss

Final thoughts

Both stories are wins for the domain ecosystem. Blockchain.ai proves there’s still room for headline six-figure sales when the keyword and TLD align with deep market demand. The Onchain cluster shows how demand can show up quickly and in multiples—an important pattern to notice if you’re building a portfolio.

If you’re building your own domain strategy, use these sales as case studies: ask who the buyer could be, why they’d want the name, and how you could replicate that reasoning for other keywords. Above all, keep learning the market: the next breakout keyword could come from a place you didn’t expect.